How Treasury Bills Offer Tax Benefits for Smarter Cash Strategies

U.S. Treasury bills (T-bills) are a cornerstone of corporate cash management strategies, offering unparalleled safety, liquidity, and tax efficiency. For corporate treasurers managing significant cash reserves, understanding the tax implications of T-bills is essential for optimizing yields and ensuring alignment with financial objectives.

How Are T-Bills Taxed?

T-bills, as debt securities issued by the U.S. Treasury, are subject to a straightforward taxation structure: The interest income earned on T-bills is federally taxable at ordinary income rates but benefits from exemptions at the state and local tax levels. In some cases where T-bills are sold on the secondary market prior to maturity, profits from T-bills may be treated as capital gains rather than interest income.

What Are the Tax Advantages of Treasury Bills?

State and Local Tax Exemptions

The primary tax advantage of T-bills for corporate treasurers is their exemption from state and local taxes. This unique feature can significantly reduce the overall tax burden, especially for entities operating in high-tax jurisdictions. While the interest income earned on T-bills is subject to federal taxation at ordinary income rates, the savings at the state and local levels enhance their attractiveness compared to other short-term instruments.

Potential Tax Deferrals

Corporate treasurers can time T-bill purchases to align with their fiscal year or tax periods. This alignment ensures that interest income is recognized at optimal times, matching cash flow requirements and tax planning needs. T-bills are taxed during the year that they mature, allowing a Treasurer could delay taxes on interest for a year by purchasing T-bills that mature the next tax year.

After-Tax Yields

Calculating after-tax yield is a helpful formula for treasurers to understand after-tax returns and compare short-term instruments with different tax treatments. This nuanced understanding enables more informed decisions, ensuring that the after-tax returns align with a treasurer’s financial goals and liquidity requirements.

Example

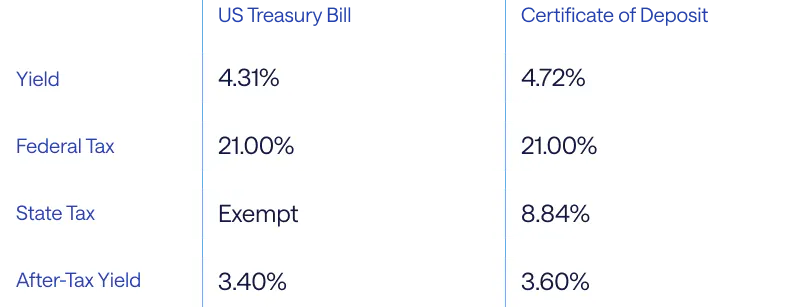

To see the impact of tax exemptions at the state and local level in action and an example of comparing securities using the formula, below is a theoretical example of a Treasury bill (T-bill) and a certificate of deposit (CD). The nominal yield of the CD is over 40 basis points higher, but after taxes, the yields are comparable.

The example above is for illustrative purposes only. Actual tax calculations will vary. The example assumes a fixed 21% federal tax rate, and an 8.84% state tax rate, with no other taxes applied.

With the state tax exemption, the after-tax yield of the T-bill can be calculated with the following formula:

Whereas calculating the after-tax return of the CD also includes the state tax:

Tax Missteps to Avoid with T-Bills

Despite their simplicity, there are common pitfalls that corporate treasurers should avoid when investing in T-bills directly.

Overlooking Market Discount Taxation

Secondary market purchases may include a market discount, which is treated as additional interest income and must be accounted for appropriately.

Poor Documentation and Reporting

Incomplete records of T-bill transactions can complicate tax reporting and increase the risk of compliance issues.

Additional Considerations

The tax implications of various short-term investments affect their overall returns. They should be a strong consideration in the strategic allocation of corporate cash.

It is important to acknowledge that each corporation's tax situation is unique. To ensure that your investment strategy is both tax-efficient and compliant with current tax laws, consulting with a qualified tax professional is highly recommended.

Further reading

4 Mistakes Treasurers Need to Avoid When Investing in a Money Market Fund

What Are Money Market Funds? Money Market Funds (MMFs) are a type of mutual fund that invests in short-term, relatively liquid financial instruments. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance.. Read more →

How Treasury Bills and Money Market Funds React to Falling Interest Rates

The Federal Reserve adjusts interest rates as a primary tool to manage inflation, support economic growth, and maintain financial stability. Read more →