Berkshire Hathaway’s $234 Billion Bet? Here’s What Treasurers Need to Know

When Warren Buffett makes a move, the world pays attention: the Oracle of Omaha recently surpassed the Federal Reserve in short-term Treasury holdings!

A cash management strategy heavy on T-bills is optimal: it prioritizes safety and liquidity while reaping the returns associated with the safest short-term instrument.

The T-bill bandwagon has exploded in popularity in the last few years, and Buffet was no exception, stating “Berkshire bought $10 billion in U.S. Treasuries last Monday. We bought $10 billion in Treasuries this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month.” in a CNBC interview in August of 2023. These T-bill laddering considerations are common for professional treasurers as they manage the company’s short-term cash needs.

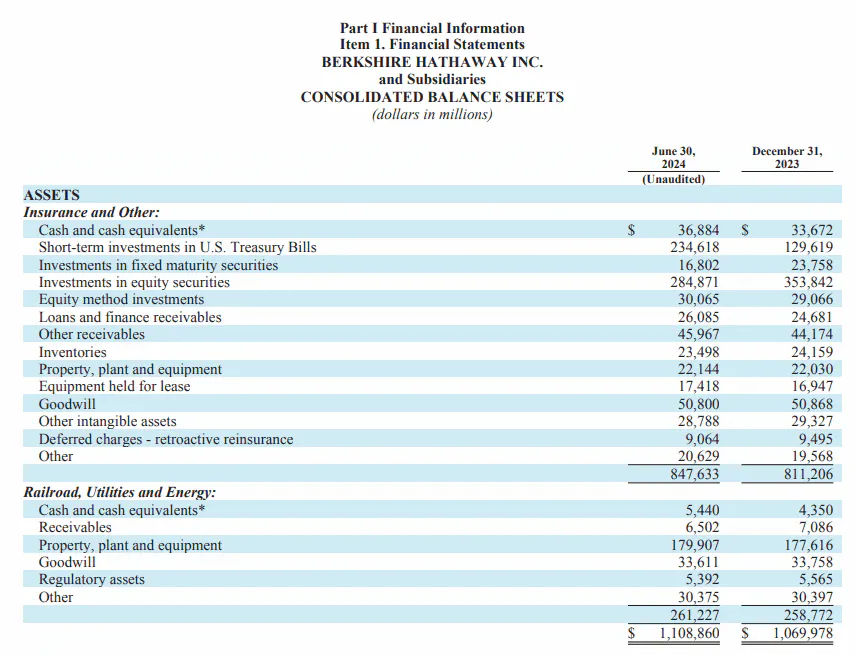

In the first half of 2024, Berkshire increased its T-bill holdings by 81% year-to-date, reaching $234 billion in June. While Berkshire is set up to earn billions on those positions alone (if held to maturity), this isn’t a short-term play to chase yield by any means. It is a sound foundation.

Berkshire Hathaway Consolidated Balance Sheet

Why T-Bills Are Central to Warren Buffett’s Cash Strategy

In his 2022 Annual Report, Buffet stated, “Berkshire will always hold a boatload of cash and U.S. Treasury bills.” Even in a near-zero rate environment through 2021, Berkshire held $144 billion in T-bills. That’s because T-bills add value to a portfolio regardless of the rate environment. Why is that?

Safety

T-bills are backed by the full faith and credit of the U.S. government, one of the most reliable borrowers in the world with a flawless track record of meeting its debt obligations. From a cash investment standpoint, that’s about as good as it gets.

Compared to other bonds issued by the U.S. Treasury, T-bills have short maturities (4 to 52 weeks), which means they have the least exposure to interest rate risk and are therefore subject to minimal price variation. Even within the “Bill” category, Buffet has been vocal about focusing on shorter-term options like the 6-month bill and below to further mitigate this risk.

This combination of low default and interest rate risks makes T-bills a trusted option for preserving capital.

Flexibility & Liquidity

Because of their safety, minimal price fluctuation, and high demand, T-bills can, in theory, easily be converted to cash or purchased on the secondary market. So much so that for accounting purposes, short-term bills can even be booked as cash equivalents.

T-bills are the fundamental building block of liquidity for most large financial institutions. In times of stress, they are the primary asset that banks or hedge funds keep for cash on hand and collateral posting.

Tax-Advantaged Returns

The interest income from T-bills is typically exempt from state and local taxes, which can make T-bills especially attractive to corporations in states with high income tax rates.

Counterparty Risk Considerations

The purity of direct ownership a-la Berkshire removes counterparty risk considerations inherent to most other cash products: Money Market Funds (which almost always involve some repo facilities), CDs, and term deposits all involve balance-sheet exposure to underlying banks. By holding bills directly, Warren Buffet ensures that he only faces the custodian of the government securities with as few intermediaries as possible. Understanding the chain of custody can mean life or death in times of financial stress.

T-bills are the Foundation

What Warren Buffett’s strategy demonstrates is that T-bills are the ultimate starting point for safety and liquidity. Other products, such as MMFs or term deposits, which may from time to time outperform the yield on T-bills, should only be used for further yield boost, after understanding the risks associated with the diversified counterparties involved. T-bills aren’t another investment vehicle—they’re simply the pure foundation for professional treasury cash management.

Further reading

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance.. Read more →

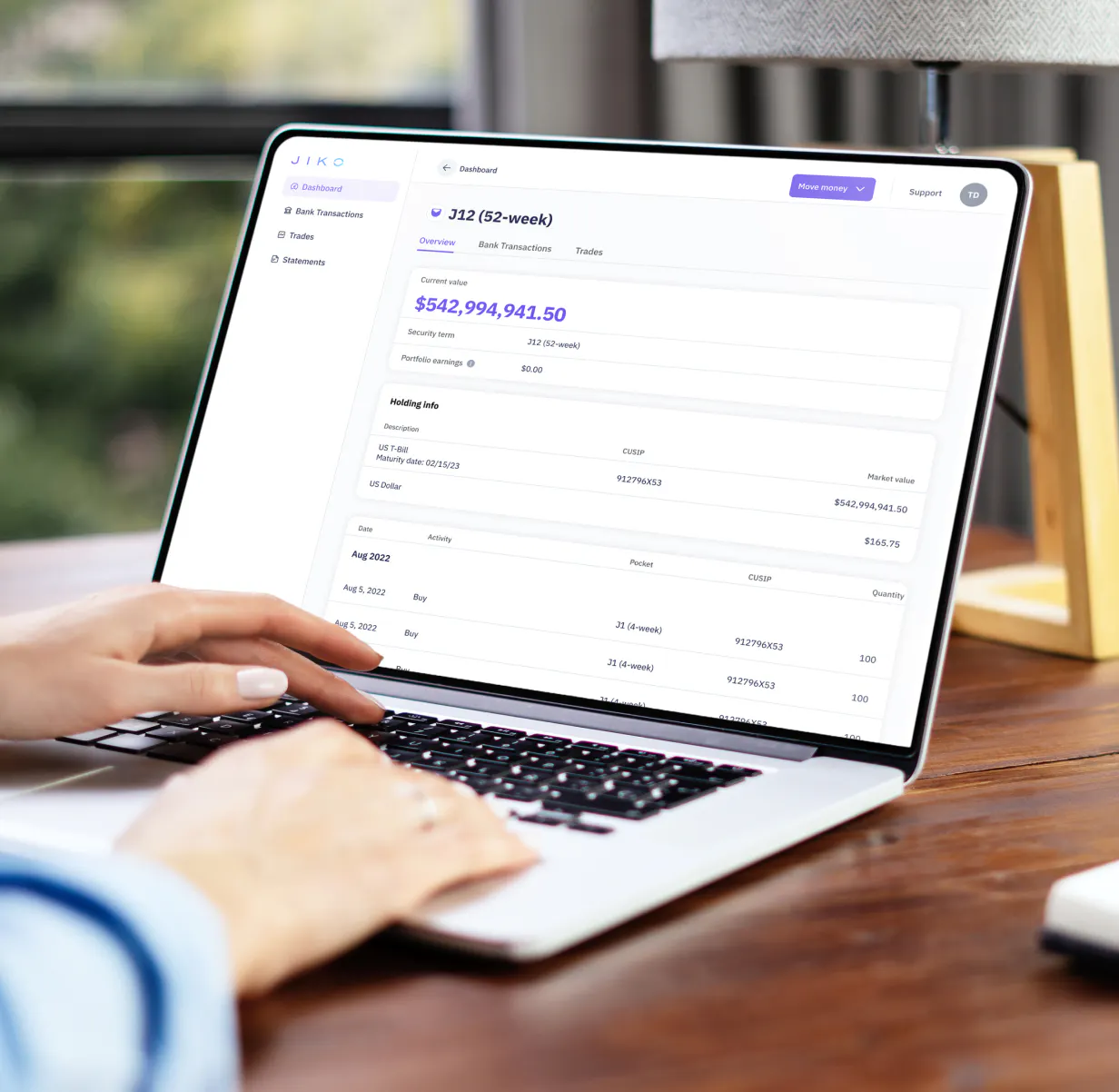

Improving T-bill Access: How Jiko Makes the Deployment of Corporate Cash Into T-Bills Simple and Transparent

Treasury bills are a foundational component of the US financial system, yet, purchasing T-bills directly from a broker can be a cumbersome and costly task even for established treasury teams. Read more →