The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. However, deploying cash positions in T-bills typically require interacting with a broker-dealer, and some mistakes can be costly. Here’s a closer look at three critical missteps and how corporate treasurers can avoid them.

1. Not Checking the Execution Price Each Time

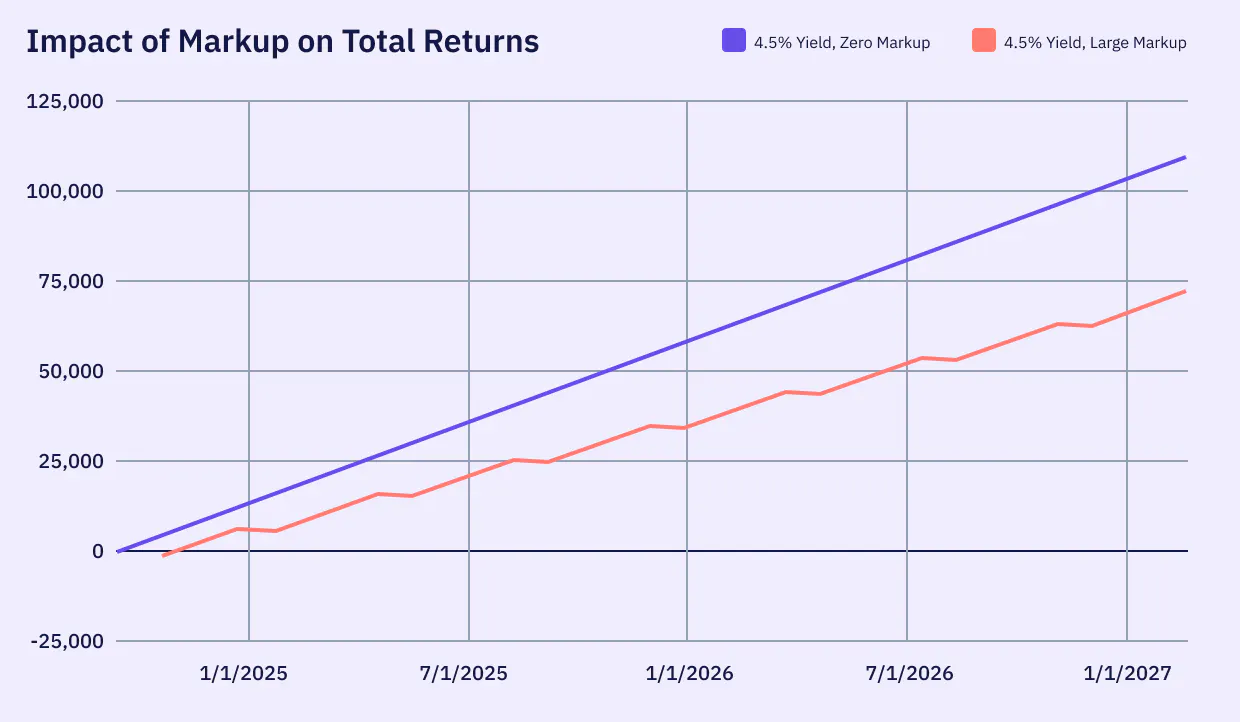

When a treasurer purchases a Treasury bill, they are executing a securities transaction, which involves crossing a dealer’s bid/ask. The spread between the purchase price (ask) or sell price (bid) versus the mid price in the general inter-dealer market at that moment, is important: if the dealer is greedy, the spread can drag on performance. Frequent trades can add to that friction. For a busy treasury team, managing possibly several entities within a group, determining the spread paid on a bond trade can be challenging and cumbersome, since it’s not easy to determine the market price of a given T-bill, and spreads or markups aren’t typically disclosed on order tickets. Some brokers offer low spread, while others impose substantial markups (on purchases) or markdowns (on sales). Without a reliable pricing source for comparison, treasurers might be unaware of an unfair markup on your T-bill trade. Below we show a hypothetical comparison of returns for one investor with 4.5% annual yield and zero cost compared with another investor who purchases the same bonds but pays a markup when reinvesting.

This comparison is for illustrative purposes only and is based on a hypothetical scenario. It assumes an investor earns a 4.5% annual yield on Treasury bill investments, with consistent reinvestment at the same rate over a two year period. For the scenario reflecting cost drag, the costs are modeled as a 40-basis-point (0.40%) markup applied quarterly during reinvestment. Actual results may vary based on factors such as changes in yields, reinvestment schedules, and cost structures. This example does not account for taxes, inflation, or other investment-related fees, which may further impact net returns.

2. Missing an Expiry

An active cash account that is deployed in T-bills may have a number of short-term securities expiring at any given time, perhaps as often as twice a week. At expiry, T-bills become cash, and unless a new trade is done that day, a treasury team may end up holding uninvested cash, exposed to an underlying bank’s balance sheet for several days with a potential impact on the return as well. This is particularly problematic if the custodian pays a below-market interest rate on cash balances. It is critical for treasury teams to organize themselves to track all expiries or rely on solutions that are actively alerting or better, automatically roll positions.

3. Selecting On-the-run CUSIPs

The universe of short-term government securities is vast. It includes 30-year-old coupon-bearing bonds with 6 weeks left to maturity. Those, while having short exposure to the US government, do not necessarily trade as tightly as the latest one-month T-bill. At any given time, the most liquid 1-month, 3-month, 6-month, and 12-month bills are those recently auctioned by the US Treasury, and those are referred to as ‘on-the-run’ bills. All other bonds/bills are ‘off-the-run’ and can trade with wider bid-ask in the secondary market. When calling a broker or executing on a screen, it is important for the treasury team to verify that at purchase, they are executing on ‘on-the-run’ securities to ensure minimal slippage on price, and more liquidity should they need to unwind their positions.

Further reading

Improving T-bill Access: How Jiko Makes the Deployment of Corporate Cash Into T-Bills Simple and Transparent

Treasury bills are a foundational component of the US financial system, yet, purchasing T-bills directly from a broker can be a cumbersome and costly task even for established treasury teams. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance.. Read more →

Case Study: How an Illinois Treasurer Optimized Public Funds Management with Jiko Pockets

Background When Thornton Township’s Treasurer, responsible for managing public funds for 12 Illinois school districts, attended the Association of Financial Professionals (AFP) Conference in 2023, they weren’t expecting to find a groundbreaking solution to their cash management challenges. Read more →