Case Study: How an Illinois Treasurer Optimized Public Funds Management with Jiko Pockets

Feb 07, 2025

Background

When Thornton Township’s Treasurer, responsible for managing public funds for 12 Illinois school districts, attended the Association of Financial Professionals (AFP) Conference in 2023, they weren’t expecting to find a groundbreaking solution to their cash management challenges. But after stopping by Jiko’s booth for a demo, they were immediately intrigued by the safety, liquidity, competitive returns, and simplicity of Jiko Pockets.

The Challenge: Optimize Safety, Liquidity, and Yield for Public Funds

Managing public funds for 12 school districts comes with a unique set of challenges for Thornton’s treasurer. While state funding provides a steady stream of cash, the bulk of local revenue comes from property taxes, most of which are collected during the spring and fall. This creates a cash flow cycle where cash peaks seasonally after tax collections, but slows during the winter and summer months. Seamless access to cash is crucial year-round as funds are spent to meet the district’s operational needs, requiring careful planning from Thornton’s treasury team to ensure liquidity for payments.

Use of Multiple Accounts and Expensive Asset Managers

The treasurer relied on a mix of financial tools to manage these fluctuations in cash. Cash was spread across various accounts, with the majority being swept into Local Government Investment Pools (LGIPs) to access a pool of short-term securities with high liquidity. However, because LGIPs are fund wrappers, Thornton understood that counterparty risks of the underlying assets like repurchase agreements and commercial paper could expose their cash to liquidity issues during market stress, a risk they wanted to eliminate.

Thornton also utilized an asset manager, where the fees charged were significant, causing a drag on performance over time.

While these cash vehicles provided the required liquidity and were relatively low risk, they lacked the safety, transparency, and flexibility Thornton desired for its public cash.

Transparency and Variable Returns

Another downside of investing through an asset manager and LGIPs is the lack of transparency and control, and a reliance on the asset or fund manager to optimize for safety and yield. While convenient for treasury teams with limited trading resources in-house, the issue for Thornton’s treasurer was that a) he never truly knew where the cash was, and b) he wasn’t able to accurately forecast returns during the cash flow cycles since returns were variable.

Jiko Pockets of 4-weeks, 12-weeks, 26-weeks and 52-weeks gave us plenty of investment options without our having to worry about liquidity. We achieved high returns, low fees, safety, and were not fearful of unexpected expenditures requiring unplanned liquidations because the funds are liquid. Their T-bill platform is easy to master, their customer service and response times are top-notch, and their website is well-designed for statements, transactions, and trades.

We have had the same account manager since we met in San Diego and he checks in with us routinely. There are no concerns to address because Jiko is really quite that simple.

Mark Sheahan

Treasurer, Thornton Township Trustees of Schools

Operational Complexity

Treasury bills had been evaluated by Thornton as a destination for public funds and were recognized as an ideal solution for managing public funds. As one of the safest investments available, T-bills provide direct backing by the U.S. government, predictable and competitive yields, and flexibility through a range of maturities. The issue, however, was the time and resources required to actively trade and manage T-bill investments with so many other priorities for their treasury team; a deterrent for many treasury teams looking to store cash in T-bills.

The manual processes required for purchasing, tracking, and rolling T-bill investments are burdensome—particularly for a treasurer already managing the complex cash flow needs of 12 school districts, and the primary reason for leveraging LGIPs and fund managers in the first place. Thornton’s treasurer was seeking a simpler, more streamlined approach, and while T-bills checked all the boxes for a cash destination, they would add complexity to the treasury function.

The manual processes required for purchasing, tracking, and rolling T-bill investments are burdensome—particularly for a treasurer already managing the complex cash flow needs of 12 school districts

The Solution: Jiko Pockets

When Thornton’s treasurer learned about Jiko's platform, which offers automated, direct investment in T-bills, it immediately piqued his interest. Jiko eliminates the operational hurdles of managing T-bill investments while preserving their safety and liquidity.

Automation

Jiko Pockets automate the purchase, reinvestments at expiry, and sale of T-bills when funds need to be accessed, eliminating the manual Jiko clients get the benefits of direct T-bill investment without selecting CUSIPS, checking execution pricing, and monitoring maturities to reinvest promptly, like the experience buying T-bills from a broker. Even for the most experienced cash managers, purchasing T-bills through a broker can lead to costly mistakes.

Competitive Returns

By directly investing in T-bills, Jiko clients generate returns competitive with fund wrappers like LGIPs and Money Market Funds. Additionally, returns from a fund wrapper are variable depending on the performance of the underlying assets, whereas T-bill rates are locked at the time of purchase, allowing Treasurers to plan for liquidity with a higher level of precision.

Jiko also helped Thornton reduce the costs of managing cash. By switching from an asset manager to Jiko, Thornton cut fees in half.

On-Demand Liquidity

The beauty of the Jiko platform is Pockets pair T-bill investments with the functionality of a bank account. In just a few clicks, Treasurers can withdraw from Pockets, triggering liquidation with T+1 (if not same day) settlement. Penalty-free, on-demand access to cash allows Thornton to be flexible and quickly address unexpected expenses.

Simplicity

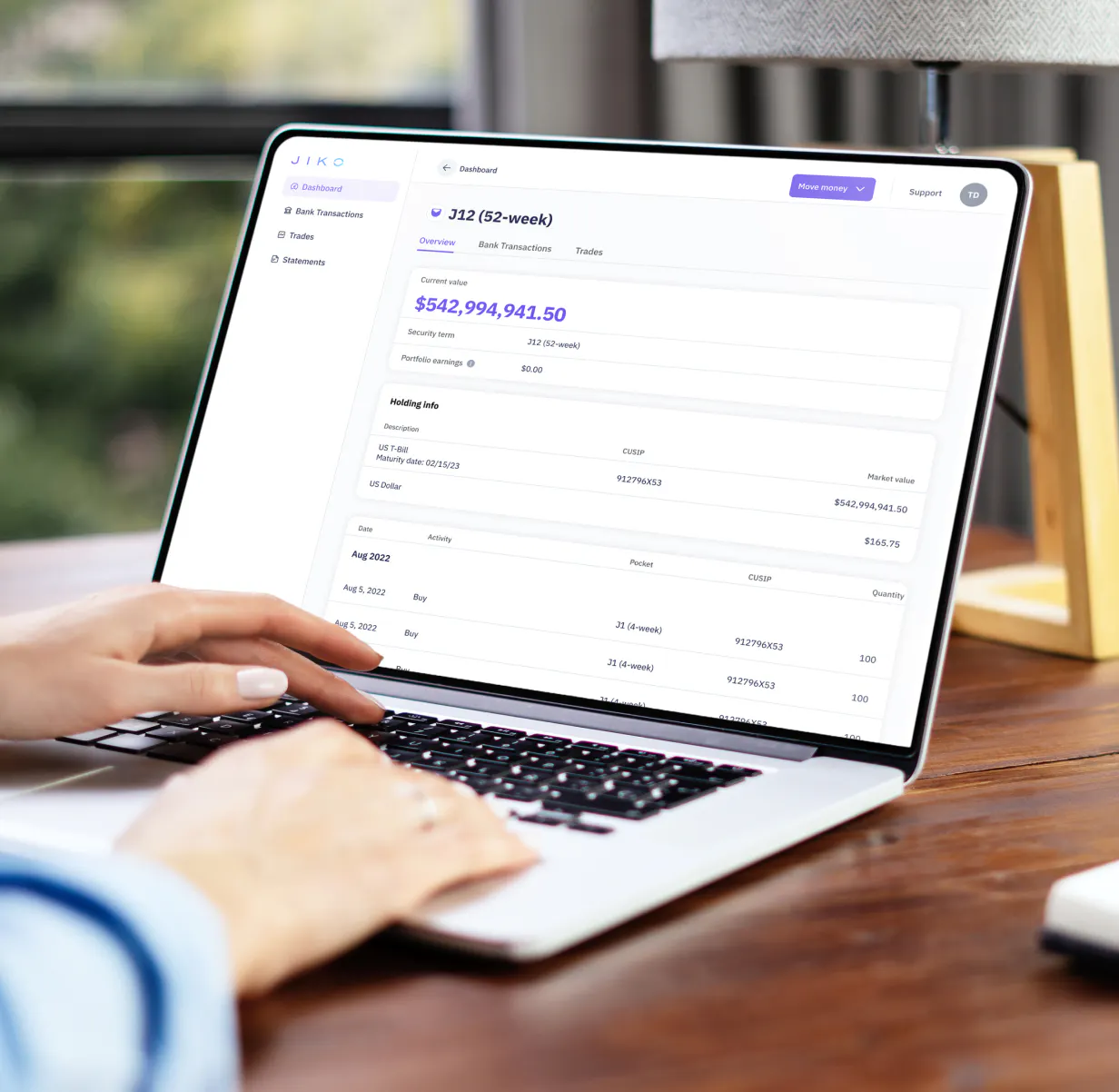

Jiko streamlines T-bill investment with an easy-to-use platform. Not only is the burden of manually trading T-bills eliminated, but the business dashboard offers clear visibility into statements, transactions, and trades for accurate reporting.

Safety

Thornton reduced counterparty risk by moving away from fund wrappers and investing directly in government-backed T-bills, ensuring safety and access to funds in any economic environment.

Maturity Selection

With multiple maturity options ranging from 4 to 52 weeks, maturities can be tailored to align with fluctuating cash flow cycles and allow Thornton to lock in T-bill rates for precise forecasting. The control and transparency that this granted Thornton was a big driver for making the switch to Jiko.

Jiko provides a solution that directly addresses Thornton’s key challenges. With Jiko Pockets offering direct investment in T-bills paired with operational simplicity, Thornton can manage cash flow fluctuations more effectively. Jiko’s ability to simplify T-bill investments and provide excellent liquidity enables Thornton to maintain safety and liquidity while generating yield and reducing operational complexity.

Conclusion

For municipal treasurers like Thornton’s team, the challenges of managing public funds can be complex—balancing safety, liquidity, and yield while navigating complex cash flow cycles and operational hurdles. Jiko’s platform demonstrates that these challenges can be met with a modern, efficient solution that doesn’t compromise on what matters most.

Jiko Pockets combine the unparalleled safety of direct T-bill investments with automation, simplicity, and flexibility, making it easier than ever for treasurers to optimize cash management. By eliminating the operational burdens of traditional T-bill investing, Jiko empowers Thornton and many other treasurers to focus on serving their communities or corporations while achieving competitive returns, maintaining liquidity, and reducing fees.

Reach out today to see how Jiko can help you streamline cash management strategy and maximize the potential of your public funds.

Further reading

Improving T-bill Access: How Jiko Makes the Deployment of Corporate Cash Into T-Bills Simple and Transparent

Treasury bills are a foundational component of the US financial system, yet, purchasing T-bills directly from a broker can be a cumbersome and costly task even for established treasury teams. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance.. Read more →

4 Mistakes Treasurers Need to Avoid When Investing in a Money Market Fund

What Are Money Market Funds? Money Market Funds (MMFs) are a type of mutual fund that invests in short-term, relatively liquid financial instruments. Read more →