Especially in today’s elevated rate environment, corporate treasurers are largely seeking its benefits while still maintaining liquidity and protecting principal. Having a high allocation of cash in regular bank deposits can mean losing purchasing power to inflation and missing out on yields from the current high-rate environment, but being too aggressive can have severe consequences for your business. One often overlooked asset that can help corporate treasury teams find that balance? US Treasury bills.

A Treasury bill, or T-bill, is a short-term debt obligation issued by the US government, with maturities ranging from four weeks to one year, for investors to park their money, securely, for a short period while earning a set interest rate. Despite the simplicity of T-bills, they serve as linchpins in monetary policy and investment strategies for treasurers worldwide because they sit at a compelling cross-section of safety, liquidity, and yield – three fundamental facets of the modern treasury function.

Safety

Backed by the full faith and credit of the United States government and commonly referred to as earning the “risk-free rate,” T-bills are a very low-risk investment option for corporate treasurers looking to preserve capital. Because of this inherent safety, T-bills can be leveraged as a diversification instrument alongside regular bank deposits and Money Market Funds, to minimize risks inherent to those holdings. While government MMFs are a popular cash destination for Treasurers, there are limitations in the way funds are structured. Indeed, these sometimes include T-bills pooled alongside other levered short-term assets like repos and commercial paper.

Liquidity

T-bills are highly liquid assets, meaning they can be easily bought and sold in the secondary market, providing corporate treasurers with flexibility in managing their cash positions. They can easily convert T-bills into cash if needed without incurring significant transaction costs or delays.

The risk of selling assets at a loss due to fluctuations in the market value, commonly referred to as mark-to-market risk, of liquidating a T-bill is low compared to other investments, especially when it’s close to maturity. As soon as a T-bill is purchased, the investor accrues interest daily until maturity. Barring any severe rate hikes during that period, the risk of losing principal due to early liquidation is typically mitigated in a matter of days because of the interest the investor has accrued. Essentially, Treasury teams invested in T-bills can be nimble without added risk.

Yield

In 2023, rates hit some of the highest levels in more than 20 years, and have stayed north of 5%* since. Because bank rates and Government Money Market Fund (“MMF”) yields mirror the fed funds rate, T-bills have historically remained competitive with those vehicles in any environment. In addition to ditching the counterparty risk of the other assets in the fund, one of the key benefits of T-bills is locking in a rate at the time of purchase. This can serve as a particular advantage in an environment with looming rate cuts, which is what we’re experiencing in 2024, as T-bills are a sought-after asset when rates decline. While the popularity of MMFs is partly due to them being an easier way to get exposure to T-bills as compared to buying T-bills manually from your bank or broker (which is even clunkier and more time-consuming), MMFs typically have a variable rate that decreases when the Fed lowers rates.

An added benefit of direct investment

Investing directly in T-bills, however, allows you to lock in your rate at the time of purchase, so you’ll continue to earn at a rate over 5%* until maturity regardless of what the Fed does.

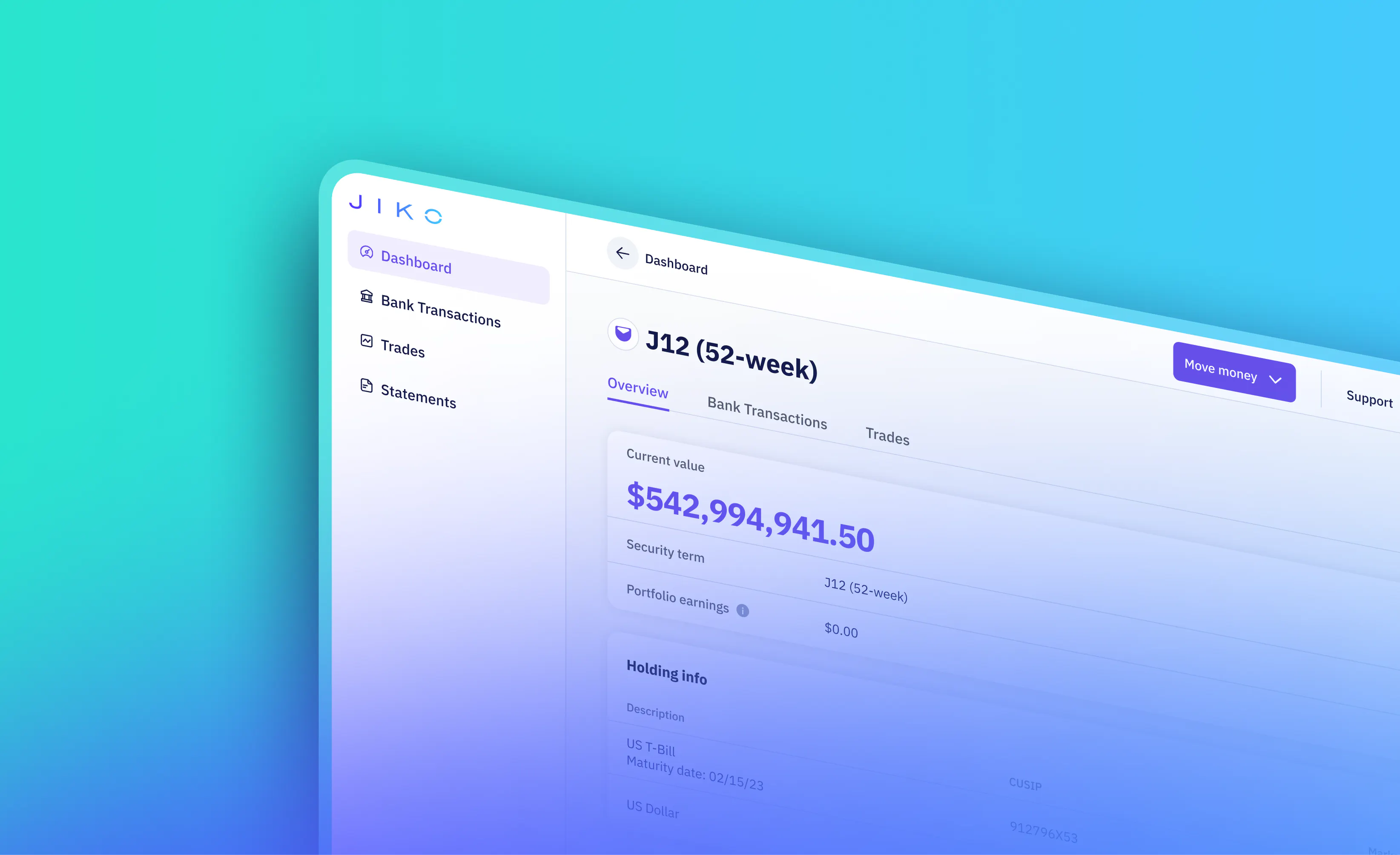

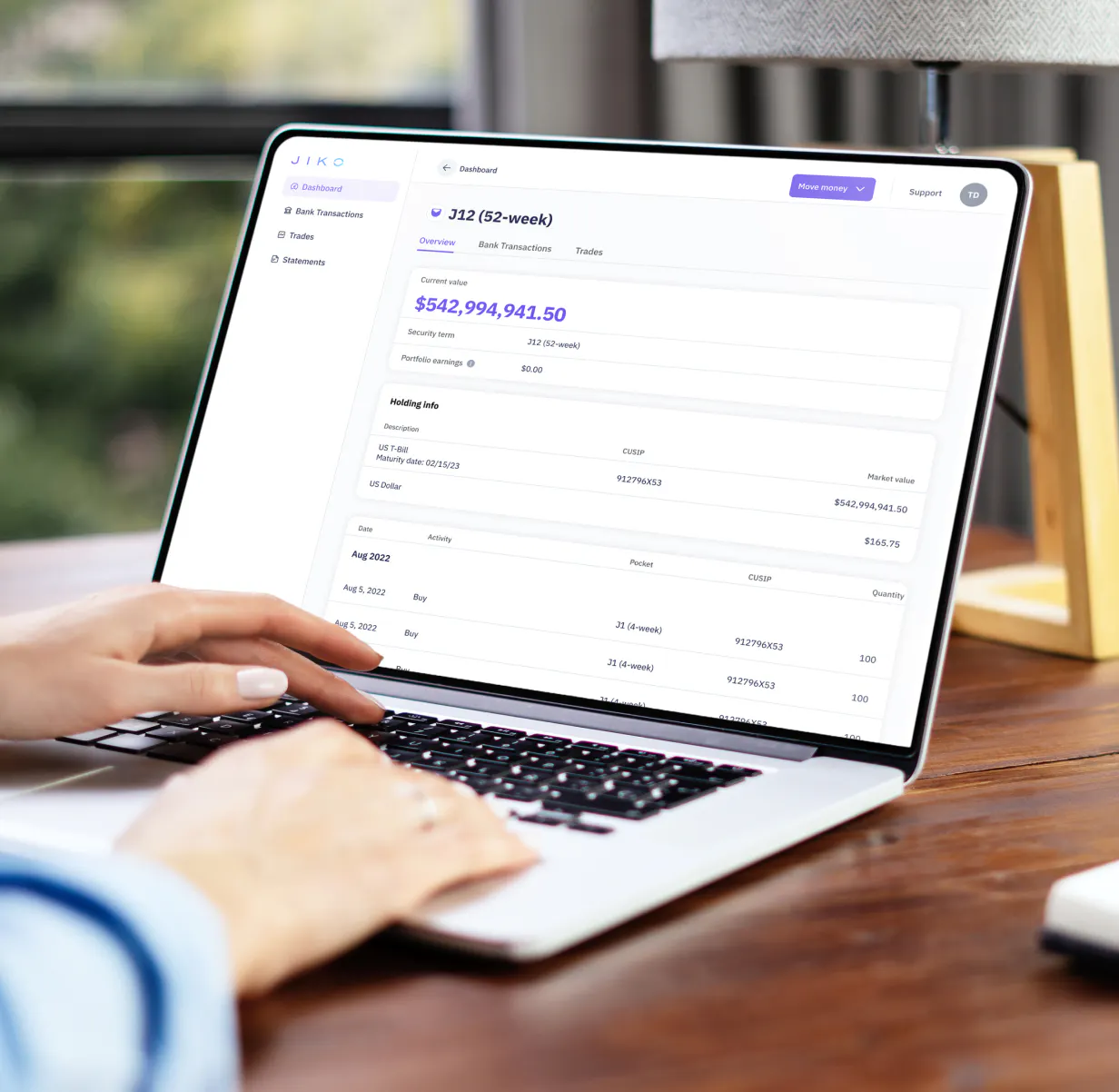

Thankfully, Jiko Corporate finally makes investing directly in T-bills easy for corporate treasury teams by automating the investment process and integrating banking rails for a fluid flow of funds between T-bill holdings and operating accounts. Essentially, Jiko provides the tools to reap the benefits of T-bill investment without the manual work with your broker. The platform also empowers teams to respond to any change in interest rates by investing in longer-duration T-bills should there be a sudden drop in interest rates. With integrations in some of the leading treasury-management platforms, treasury professionals can leverage the power of Jiko where they’re already working.

*Yield rate reflects 4-week T-bill rate (as of 04/25/24) when held to maturity. The rate displayed is gross of fees. See the US Department of Treasury website for the latest rates.

Further reading

How Treasury Bills Offer Tax Benefits for Smarter Cash Strategies

U.S. Treasury bills (T-bills) are a cornerstone of corporate cash management strategies, offering unparalleled safety, liquidity, and tax efficiency. For corporate treasurers managing significant cash reserves, understanding the tax implications of T-bills is essential for optimizing yields and ensuring alignment with financial objectives.. Read more →

Improving T-bill Access: How Jiko Makes the Deployment of Corporate Cash Into T-Bills Simple and Transparent

Treasury bills are a foundational component of the US financial system, yet, purchasing T-bills directly from a broker can be a cumbersome and costly task even for established treasury teams. Read more →