Tariffs, Treasuries, and Turbulence: Why T-Bills Still Stand Strong

A look at early April’s market volatility, shifting Treasury yields, and why T-bills remained a stable, reliable home for cash amid uncertainty.

Apr 18, 2025

April has brought a rare and jarring combination of volatility across both equities and longer-dated government bonds. With new tariffs proposed across major economies, markets reacted swiftly:

The S&P 500 dropped more than 12% in just a few trading sessions

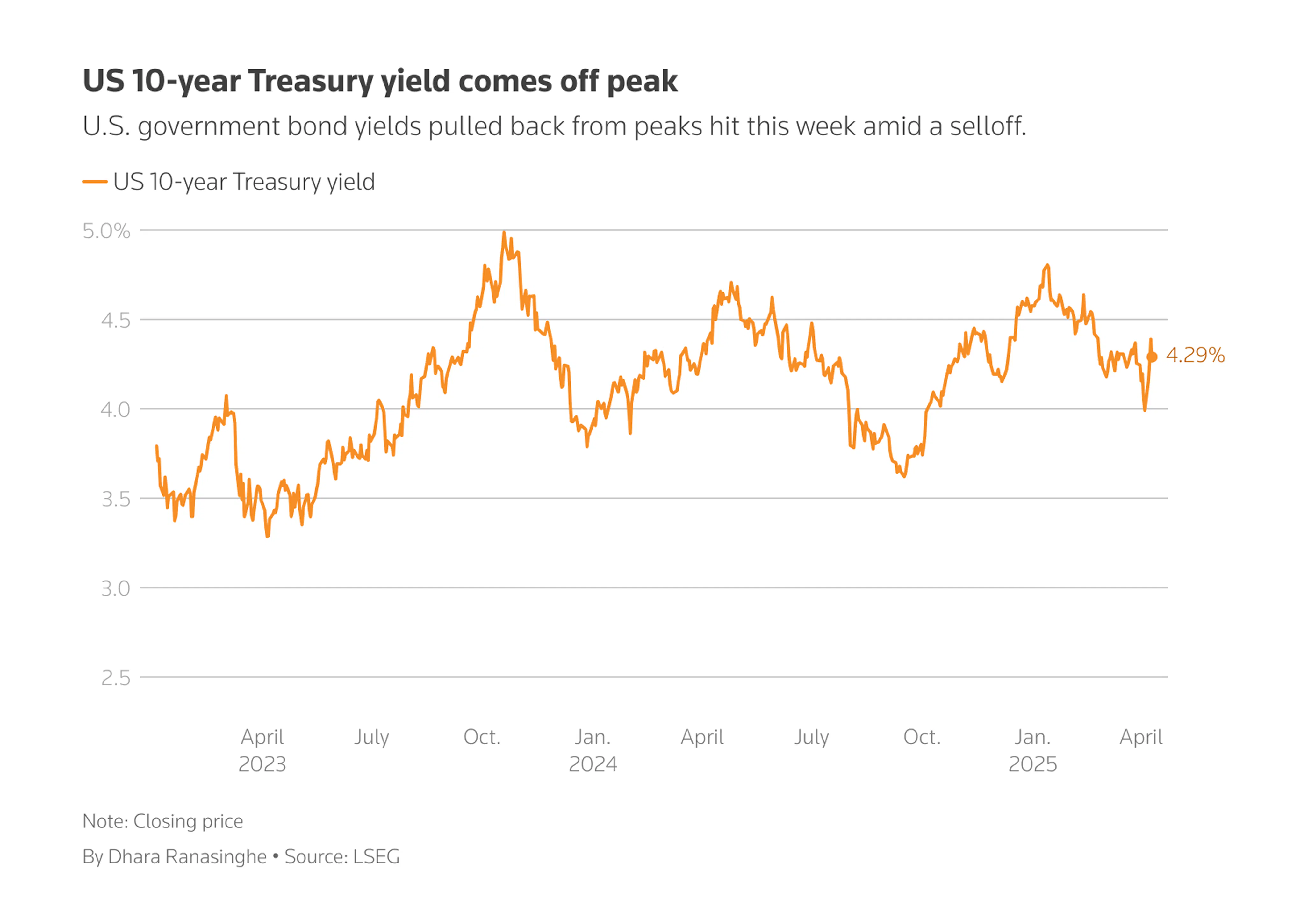

A government bond selloff saw 10-year bonds surge by more than 20 bps at one point

The past couple of weeks have been a meaningful reminder that market moves can be fast and sharp, and cash strategies must be prepared for these kinds of downturns. When it comes to the Treasury market, a couple of clarifications should be made that may bring investors some peace of mind amidst uncertainty.

Chart source: Reuters / LSEG. “US 10-year Treasury yield comes off peak,” Dhara Ranasinghe.

Reading a headline like “US Treasuries sell-off deepens as ‘safe haven’ status challenged” can rightfully raise concerns for investors, but it's important to keep in mind:

The sell-off reflected discomfort with duration risk and the possibility of larger price swings in response to interest rate and inflation expectations.

Treasuries range from 4-week to 30-year maturities. The volatility in the Treasury market last week was specific to long-term bonds.

While longer-term Treasuries experienced a sharp selloff, short-term Treasury bills (T-bills) remained stable and liquid, serving as a reliable safe haven through the turmoil. In this article, we’ll cover what happened in the bond market, explain the mechanics behind the sell-off in long-term Treasury bonds, and show why T-bills remained stable, liquid, and safe — exactly as intended.

Background

The US government issues bonds with durations from 4 weeks to 30 years, and, while they’re all technically “Treasuries,” their risk and behavior vary dramatically by maturity. T-bills are typically the least volatile type of government bond because of their short duration and minimal exposure to interest rate risk. Funds held at Jiko, for example, are exclusively invested in Treasury bills to ensure minimal risk and maximum liquidity for corporate cash in any economic or market environment.

The stability of the T-bills was demonstrated last week. The 4-week T-bill never had a daily loss through the first 10 days of April 2025, with prices fluctuating less than a basis point per day, closed within a 3-basis-point range throughout all the market chaos, while the S&P and longer-term treasuries were fluctuating wildly.

What Happened to Long-Term Treasuries?

While equities sold off in response to rising geopolitical tension and tariff news, long-term U.S. Treasury bonds — particularly 10-year and 30-year maturities — also saw meaningful price declines. Long-dated government bonds are typically seen as a refuge, offering safety when riskier assets drop. But this time, those bonds didn’t rally. They fell.

Why? Because long-term bond prices are sensitive to expectations about future inflation, interest rates, and government borrowing, all of which were questioned in early April.

Why the Selloff?

Several factors came together to pressure long-term Treasuries:

Tariff-driven inflation concerns: New tariffs raised expectations that import prices could climb, adding inflation pressure over time. Inflation erodes the value of fixed-rate bond returns, particularly for longer maturities.

Higher expected government borrowing: With deficits already elevated, the possibility of new spending or economic responses increased expectations that the U.S. would issue more long-term debt, putting downward pressure on prices.

Uncertainty about Fed policy: Sticky inflation data and strong job numbers prompted investors to reassess how long the Federal Reserve might hold rates at elevated levels. If rates stay high longer, long-term bonds become less attractive relative to shorter-term alternatives.

This wasn’t about the safety or creditworthiness of U.S. Treasuries themselves. It was about market participants repricing risk in a shifting macro environment, especially in bonds that don’t mature for a decade or more.

The Role of Basis Trades

Another factor that may have amplified the selloff in long-term Treasuries was the unwinding of so-called “basis trades” by hedge funds. In a typical basis trade, a fund buys a Treasury bond and simultaneously sells a futures contract on that bond, aiming to profit from the price difference (or “basis”) between the two.

These trades are highly sensitive to market volatility and often use leverage. When markets move quickly, as they did in early April, margin requirements can spike, forcing funds to unwind their positions. That means selling the underlying bonds, which in this case were long-term Treasuries.

Importantly, basis trades almost exclusively involve longer-duration bonds like 10- or 30-year Treasuries. Short-term T-bills are not used in these trades and were unaffected by this type of market activity.

Are T-Bills Still a Safe Haven?

Yes! T-bills are the preferred safe haven in times of uncertainty.

No Duration Risk: T-bills mature so quickly that rate changes have minimal impact on their value.

Government-Backed: Their credit quality remains anchored in the full faith and credit of the U.S. government.

Highly Liquid: Investors can quickly convert T-bills into cash without a meaningful loss of value.

Attractive Yields: Amid policy uncertainty, T-bills continue to offer competitive returns compared to cash or savings accounts, often with state and local tax advantages.

Long-term bonds may be experiencing a repricing, but that doesn’t mean the safety of U.S. government debt is in question. Instead, it reinforces a simple truth: when volatility rises and rate expectations shift, the safest place to be is often at the very short end of the curve.

Further reading

What is Even Safer Than a T-Bill Today? A T-Bill Tomorrow

Treasury Bills and the Debt Ceiling: A Look at Safety and Stability The US national debt is once again approaching the debt ceiling, reaching a point that forced Treasury Secretary Janet Yellen to take action and begin using extraordinary measures on January 21st. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance. Given volatility is inevitable, ensuring safety across all economic environments is essential. Here’s a breakdown of the characteristics of both options and the risks involved in times of market stress.. Read more →

How Treasury Bills and Money Market Funds React to Falling Interest Rates

When interest rates fall, both Treasury bills (T-bills) and Money Market Funds (MMFs) are affected, but they respond in different ways due to their distinct characteristics. Read more →