Treasury Bills and the Debt Ceiling: A Look at Safety and Stability

The US national debt is once again approaching the debt ceiling, reaching a point that forced Treasury Secretary Janet Yellen to take action and begin using extraordinary measures on January 21st. While extraordinary measures provide a temporary fix, policymakers will be faced with a critical decision in the coming weeks on whether to raise the debt limit.

Extraordinary measures essentially involve the Treasury shuffling funds between accounts to keep obligations afloat without technically breaching the ceiling. This maneuver delays the crisis but cannot provide a permanent solution, placing pressure on Congress to act swiftly.

While treasurers aren’t foreign to these debates, 2021 being the last time the debt ceiling was raised, headlines from President Trump back in December suggest a permanent solution to the recurring debt ceiling increase debates: abolishing the national debt ceiling altogether. NBC News reported Trump stated that getting rid of the debt ceiling entirely would be “the smartest thing it [Congress] could do. I would support that entirely.”

Such a significant change to fiscal policy would reduce recurring debates but will also prompt questions and carry implications for the financial ecosystem as a whole. For example, if the debt ceiling is abolished, what does that mean for treasurers managing funds in US Treasury bills? Let’s dive into the historical context, current dynamics, and what a debt ceiling-less future could look like.

Why the Debt Ceiling Exists in the First Place

Before 1917, Congress had to authorize each of the Treasury’s issuances of debt to meet its obligations. As the US entered World War 1 and war bonds to finance military operations were the most popular issuance, Congress gave the Treasury more flexibility in debt issuance for debt that had been previously authorized. The tradeoff for leniency was the establishment of a debt limit (ceiling) to more or less keep the Treasury in check when it came to accumulating debt. However, the debt ceiling’s establishment introduced a structural cap that now requires regular adjustments to accommodate the government’s growing financial obligations.

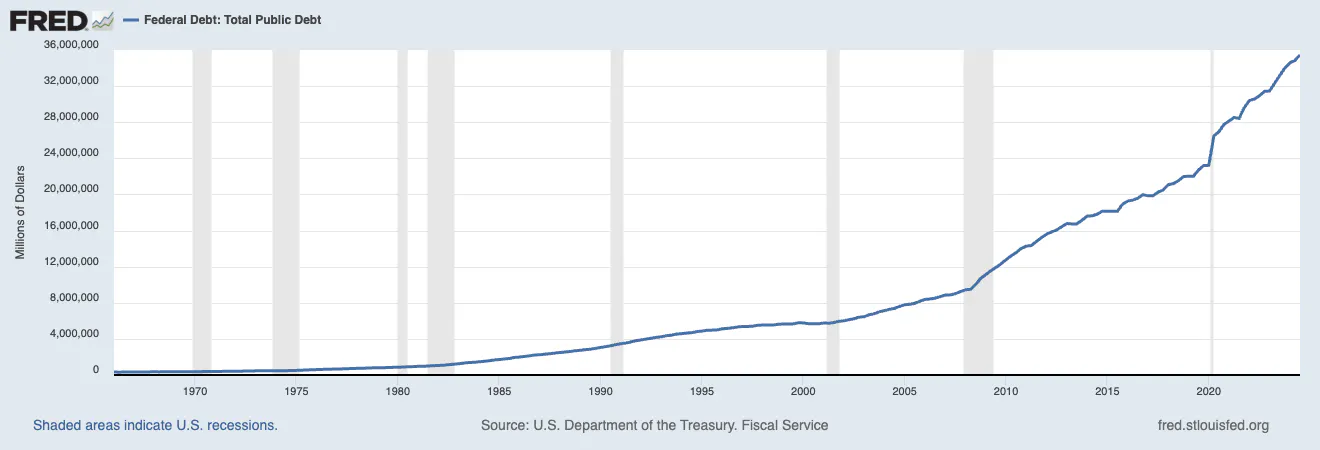

Fast forward to 2025, the debt ceiling sits at $36.1 Trillion. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit.

Historical Increases in the U.S. Public Debt (1960s–Present). Source: Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/GFDEBTN. As of January 24, 2025.

Despite its original intent to foster financial responsibility, the debt ceiling has increasingly become a contentious political tool, delaying resolutions and amplifying risks to financial markets.

How the Debt Ceiling is Reached

The US Government has minting power and therefore, in theory, the ability to repay the debt it borrows in dollars, making T-bills one of the safest investments available. However, that’s not quite how it works in practice for two technicalities.

The US Treasury, while responsible for minting money and issuing debt, does not have the power to create cash, only the ability to issue notes that are redeemable for cash. The cash creation authority actually lies with the Federal Reserve (the Fed), which has held this role since 1913 when the Federal Reserve Act was signed into law.

As a result, when the Treasury needs to raise debt to pay its bills (Medicare, Social Security checks, and even T-bills), it may need to rely on the Fed to buy T-bills if the markets don’t buy enough. When this occurs, the Treasury is actually increasing its debt to repay previous debt, while expanding the Fed’s balance sheet.

The second technicality is the debt ceiling, which as we know, was created to ensure responsible oversight of the Treasury, and puts a literal limit on an otherwise (theoretically) symbiotic relationship of borrowing and lending between the Fed and the Treasury. This limit is controlled by a third government entity: Congress.

Congress has its own agenda and can leverage the recurring debt ceiling conversations for political budgeting reasons as it creates a technical risk of default which no one wants to see happen. Fortunately, a decision to raise or suspend the debt ceiling has historically been made, as the majority of politicians, economists, and the Department of Treasury website agree that “failing to increase the debt limit would have catastrophic economic consequences.” The implications are so severe because T-bills are so ingrained and foundational to the US financial system.

Implications for T-Bill Owners as the Debt Ceiling Approaches

The last time we approached the debt ceiling, many corporate treasurers and other T-bill investors had to seriously wonder what exact CUSIP they were holding, and whether the precise expiry date would be a problem. The same worry is likely starting to brew within treasurers this week.

While few doubt an eventual raising of the debt ceiling, these experiences do create unnecessary stress, to the point where strategic reallocations are made by Treasurers owning T-bills to try and minimize settlement uncertainty. In this case, Treasurers would typically avoid holding T-bills that mature around the dates that the extraordinary measures are exhausted, reallocating to a longer maturity, if not retreating from short-term treasuries altogether.

The advantage of being nimble in these situations further highlights the benefits of holding Treasury bills directly, as opposed to indirect exposure through a fund wrapper, like a Money Market Fund. Exposure through a fund lacks control of T-bill holdings since Treasurers simply hold a share of the fund, and transparency into holdings at the CUSIP level to understand the true risk.

Debt Ceiling Removal Implications

The Treasury and investment community at large will stand by the decision from Congress in the coming days. While history is likely to repeat itself, leading to another raising of the debt ceiling, the possibility of the debt ceiling being eliminated could be, in some ways, a relief for treasurers and T-bill investors at large. While such a change would alter long-standing approaches to government borrowing and could change the shaping of fiscal policy, it would eliminate the primary (recurring) threat of a government default due to the limit being reached.

Further reading

Berkshire Hathaway’s $234 Billion Bet? Here’s What Treasurers Need to Know

When Warren Buffett makes a move, the world pays attention: the Oracle of Omaha recently surpassed the Federal Reserve in short-term Treasury holdings! A cash management strategy heavy on T-bills is optimal: it prioritizes safety and liquidity while reaping the returns associated with the safest short-term instrument. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance. Given volatility is inevitable, ensuring safety across all economic environments is essential. Here’s a breakdown of the characteristics of both options and the risks involved in times of market stress.. Read more →

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →