Jiko Launches JikoNet, a Uniquely Safe 24/7 Network for Secure High-Volume Corporate Dollar Transactions

Mar 18, 2025

The new network significantly minimizes counterparty risks by providing direct Treasury bill ownership, delivering an unprecedented scale and stability to the institutional markets, starting with the digital asset world.

San Francisco, CA – March 19, 2025 – Jiko, the technology platform and bank that provides seamless, instant, and secure access to U.S. Treasury bills to modern treasurers, today announced the launch of JikoNet, a one-of-a-kind network that enables institutions to settle high-volume transactions in real-time, while minimizing the counterparty and liquidity risks that have long burdened previous settlement network solutions. At a time when safeguarding investments and protecting short-term cash is vital, JikoNet builds on Jiko’s uniquely de-levered deposit model and modern technology stack to minimize counterparty risk by keeping every participant directly invested in T-bills.

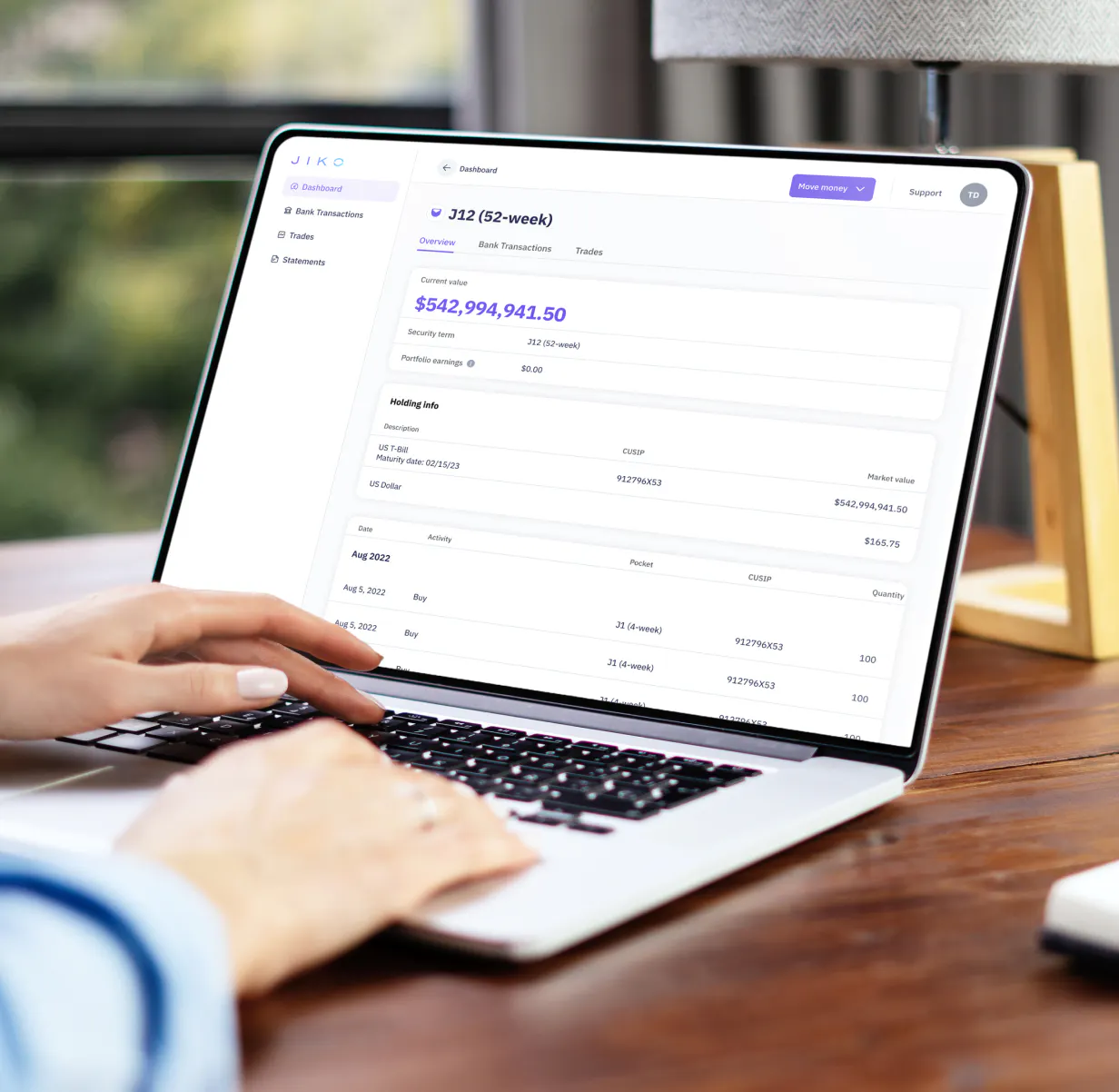

JikoNet leverages Jiko’s core innovation, Jiko Pockets, which combine the safety and yield of U.S. government-backed T-bills with the transactional capabilities of a corporate bank account. In an increasingly fast-paced financial landscape, institutions and corporations require a secure and scalable way to move sensitive funds in real-time, without exposure to traditional banking delays or balance sheet risk. JikoNet solves this by facilitating instant settlement between corporate Pockets, thus enabling trusted and seamless transactions between institutional parties. Every transaction between pockets occurs in USD on Jiko’s bank ledger, where the cash is freed up and re-invested by facilitating real-time, 24/7 sale and purchase of T-bills prior to and immediately after the payment transaction clears. As part of the launch, JikoNet allows for the formation of industry-dedicated sub-networks. One immediate application is a dedicated sub-network engineered exclusively for the institutional digital asset industry, empowering key players such as exchanges and market makers to settle in real-time, at all times, ensuring continuous efficiency in those markets.

“It’s critical to understand the novelty of our approach. With JikoNet, we ensure that client cash remains invested from the moment where a transfer needs to occur,” shared Stephane Lintner, Jiko Co-Founder and CEO. “Participants are not exposed to traditional balance-sheet risk, making us the stable network everyone can build on and rely on at scale. In our quest for safety, we removed as many intermediaries as possible, such as opaque fund structures and equity wrappers to provide our clients with direct and seamless access to U.S. government T-bills. This means that every node in our network is not only designed for maximal safety even at times of global financial stress, but also naturally yielding the risk-free rate.”

“We are very excited to roll out this safe and scalable experience for the corporate world where so many communities still have to wait for U.S. wire-hours and bank wire windows to transact,” remarked Remy Dubois, Jiko’s Chief Growth Officer, “and at times, the company’s most defining transactions such as an M&A, an aircraft delivery, or a commercial real-estate deal can get stalled.”

Jiko’s corporate platform, which now includes access to JikoNet, was built from the ground up on Jiko’s principles of trust, safety, security, and compliance. Engineered on a modern privacy-first technology stack, the Jiko corporate product suite is designed to keep pace with evolving industries via API integration and ensure seamless, safe, and scalable 24/7 transfers via JikoNet without the limitations of legacy systems.

Further reading

Jiko Secures $29 Million in Series C Funding, Strengthens Its Board and Advisory Committee

Improving T-bill Access: How Jiko Makes the Deployment of Corporate Cash Into T-Bills Simple and Transparent

Treasury bills are a foundational component of the US financial system, yet, purchasing T-bills directly from a broker can be a cumbersome and costly task even for established treasury teams. Read more →

Case Study: How an Illinois Treasurer Optimized Public Funds Management with Jiko Pockets

Background When Thornton Township’s Treasurer, responsible for managing public funds for 12 Illinois school districts, attended the Association of Financial Professionals (AFP) Conference in 2023, they weren’t expecting to find a groundbreaking solution to their cash management challenges. Read more →