With rates near their 20-year high, and Federal Reserve Chair Jerome Powell pointing to reduced inflation and a cooling job market as reasons for potential rate cuts as soon as September, investors have a window of opportunity to lock in today’s favorable rates.

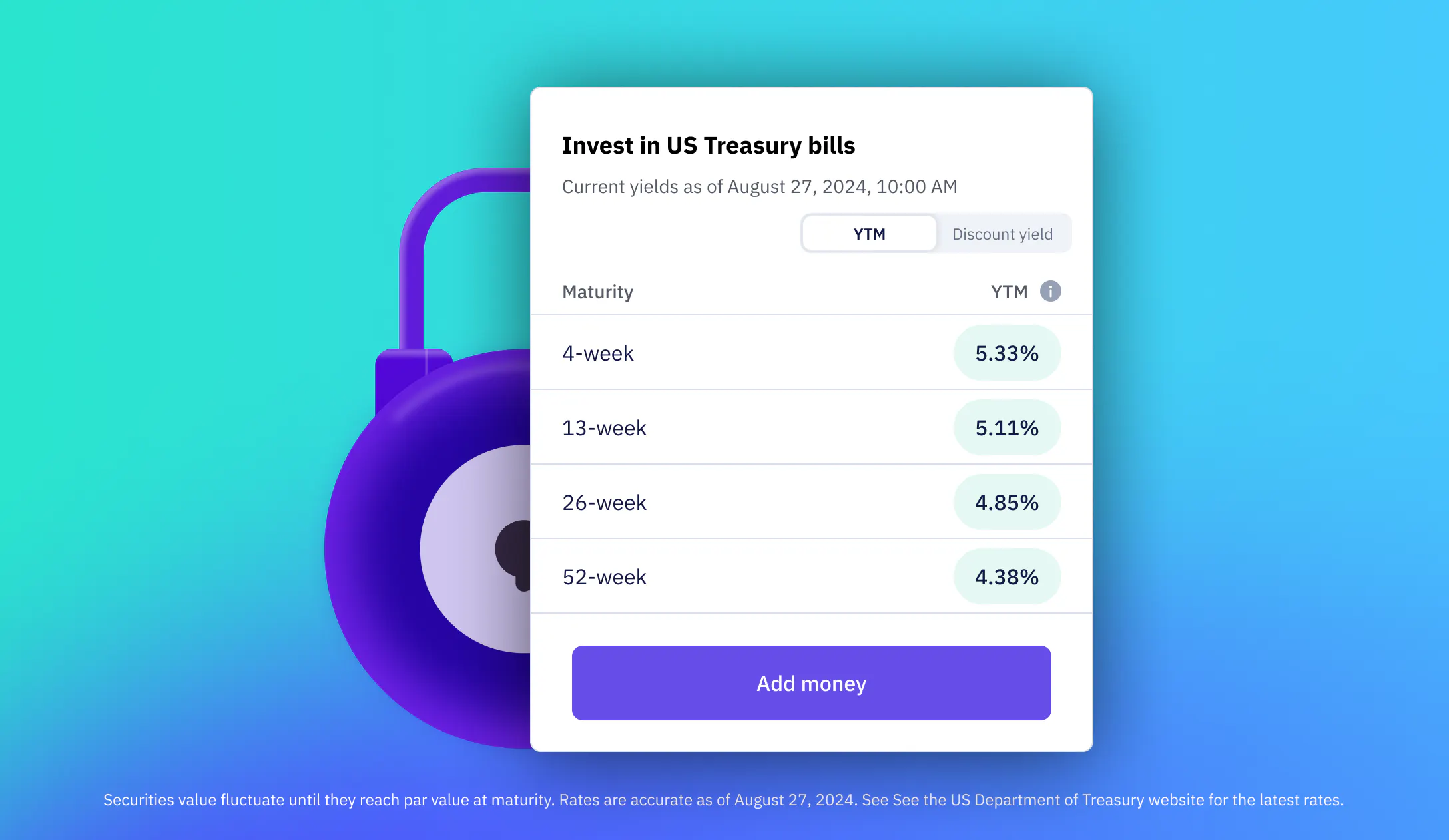

While there are several means to do so, directly investing in US Treasury bills (T-bills) with Jiko is a seamless way to secure today’s high rates and stabilize your portfolio going forward.

Key Takeaways

Fixed Rates: When you purchase T-bills, the rate is fixed at the time of purchase, unlike Money Market Funds or bank accounts that will adjust returns accordingly when rates decline. With various maturities offered, T-bill rates can be locked in for a horizon of up to 1 year.

Maintain Liquidity: Jiko provides T+1, if not same-day liquidity, allowing you to access your funds quickly without penalties — unlike a Certificate of Deposit (CD) which may have a penalty for early withdrawal. This liquidity becomes particularly advantageous in a declining rate environment; if you need to liquidate your T-bills, you may sell them at a favorable price due to the fixed rate locked in at purchase.

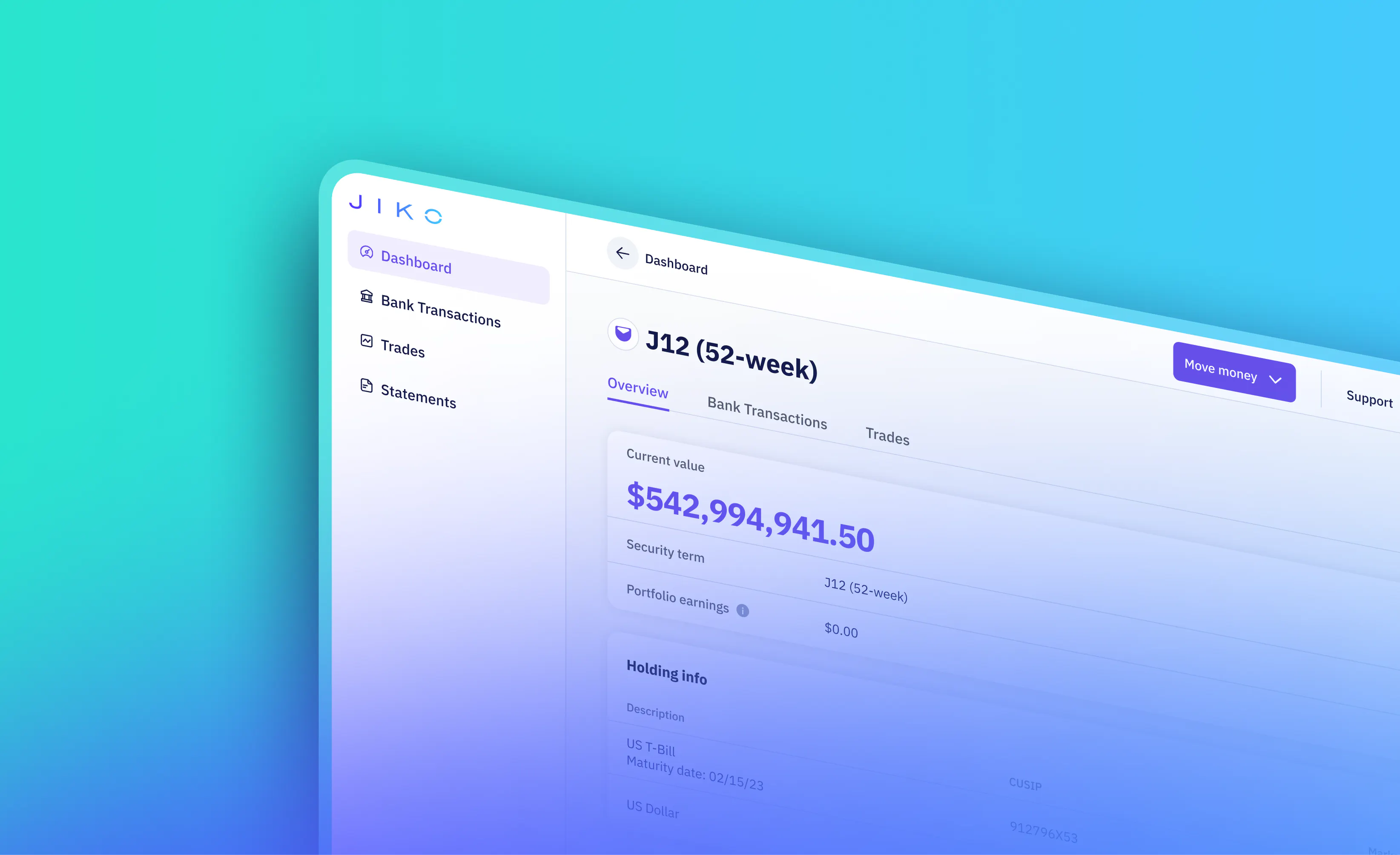

Low Maintenance: With Jiko, investing in T-bills is made simple, and the trading process is automated, ensuring that you can easily integrate T-bills into your portfolio without the hassle of managing additional software or increasing your workload.

Rate Cut Implications on Short-Term Investment Vehicles

When rate cuts are made, the returns on any short-term, low-risk vehicle (i.e. Government Money Market Funds or bank accounts) will adjust accordingly, as these products are closely tied to the federal funds rate. The financial institutions that offer these products often use Treasuries as backing, so their yields reflect the prevailing interest rates on these government securities. This is part of the reason why Jiko uses T-bills as the fuel for its deposit model, allowing any client to access the same asset financial institutions leverage to be able to offer these products.

The aforementioned products each provide unique benefits, but don’t offer the same opportunity to lock in rates on the brink of a cut as T-bills do, for the following reasons:

Government Money Market Funds are liquid and typically contain relatively safe assets. However, the returns are variable and typically have a Weighted Average Maturity (WAM) of 60 days, which suggests that returns will adjust within that time frame.

Certificates of Deposit provide the same ability to lock in the rates as T-bills but often include a significant penalty for premature withdrawal. Plus, the interest earned on CDs may be subject to state and local tax.

Bank (savings) accounts are also subject to change at the bank’s discretion as it works to manage its balance sheet.

T-bills, on the other hand, allow you to secure today’s rates for the entire duration of the bill, liquidate without fee, and offer tax advantages at the state and local levels.

While the benefits of T-bill investment before rate cuts are compelling, it’s important to understand the risks of investing in Treasuries. For instance, there's always the possibility of the inverse scenario; a sudden spike in T-bill rates. In that case, T-bills purchased before the rate increase may be priced lower in comparison to newly issued ones. We encourage all clients to carefully consider these factors when deciding to invest in T-bills.

T-Bills as a Complementary Asset

T-bills can serve as a complementary investment, providing the stability of a fixed rate alongside the flexibility and accessibility of liquid funds. With Jiko, investing in T-bills is made simple, and the trading process is automated, ensuring that you can easily integrate T-bills into your portfolio without the hassle of managing additional software or increasing your workload. This makes T-bills an effortless addition to your investment strategy, offering the benefits of diversification without adding complexity. We encourage you to check out our dashboard demo to see for yourself just how easy it is to add T-bill investment to your portfolio with Jiko.

Further reading

How T-Bills Fit Into Corporate Treasury

Especially in today’s elevated rate environment, corporate treasurers are largely seeking its benefits while still maintaining liquidity and protecting principal. Read more →

Case Study: How an Illinois Treasurer Optimized Public Funds Management with Jiko Pockets

Background When Thornton Township’s Treasurer, responsible for managing public funds for 12 Illinois school districts, attended the Association of Financial Professionals (AFP) Conference in 2023, they weren’t expecting to find a groundbreaking solution to their cash management challenges. Read more →