What Are Treasury Bill (T-Bill) Ladders?

Laddering T-bills, or Treasury bills, is a cash management strategy commonly used by some of the world’s savviest corporate treasurers, such as Berkshire Hathaway, that involves purchasing T-bills of different maturity dates at regular cadences to create a series of staggered maturities and a steady stream of returns. As each T-bill matures, the proceeds are reinvested into new T-bills with a prescribed maturity, continuing the ladder.

What Are the Benefits of Laddering T-Bills for Corporate Treasurers?

Improved Liquidity Management

The staggered maturity structure ensures that part of the corporate cash portfolio is at or close to maturity consistently. On a recurring basis, a portion of the allocated funds matures, giving the Treasury team access to cash that can be reinvested or moved. This structure offers investors a clear and predictable liquidity timeline, making it easier to manage short-term cash flow and plan for future needs.

Interest Rate Risk Mitigation

The diversity of a Treasury bill ladder also helps mitigate interest rate risk by balancing exposure to both short-term and longer-term rates so that investors may access multiple rate environments simultaneously. When rates rise, the proceeds from maturing short-term T-bills can be reinvested at higher yields, allowing Treasurers to benefit from the increased rates over time. Meanwhile, longer-term T-bills in the ladder lock in previous yields, providing stability if rates drop. Though interest rate risk is typically very small when investing in T-bills, this approach reduces the minimal impact on your portfolio while ensuring consistent opportunities to optimize yields.

Tailored to Financial Goals

A T-bill ladder offers significant flexibility, allowing investors to tailor it to specific financial goals and timelines. Maturities can be selected to align with various needs, ranging from short-term to longer-term T-bills, while the allocation amount can be adjusted based on cash flow requirements. The timing between purchases can also be customized to create a steady stream of maturing funds or to align with specific intervals. Ladders can be established gradually with single maturities or more quickly by investing in multiple maturities simultaneously. This adaptability makes T-bill ladders a practical and versatile solution for managing liquidity and optimizing yields.

How to Ladder T-Bills

Imagine setting up a series of rungs on a financial ladder, each representing a T-bill maturing at a different time. Each rung, or T-bill, matures at a regular interval, giving you periodic access to your investment. A ladder can be set up in just a few steps:

1. Define Investment Amount and Objectives

Before setting up a T-bill ladder, determine the total investment amount and outline financial goals, such as ensuring regular liquidity or maximizing returns over a certain period.

2. Choose T-Bill Maturities

Select the appropriate maturities for the ladder, considering factors like the desired cash flow frequency and exposure to different interest rates.

3. Make Initial Investments

Invest in the chosen T-bills, ensuring the investments are spread across the selected maturities to establish the ladder’s structure.

4. Reinvest Proceeds to Maintain the Ladder

As T-bills mature, reinvest the principal and interest into new T-bills, maintaining the ladder’s structure and ensuring continuous liquidity.

5. Monitor and Adjust the Ladder

Regularly monitor the ladder’s performance and adjust the maturities or investment amounts as necessary based on changes in financial goals or market conditions.

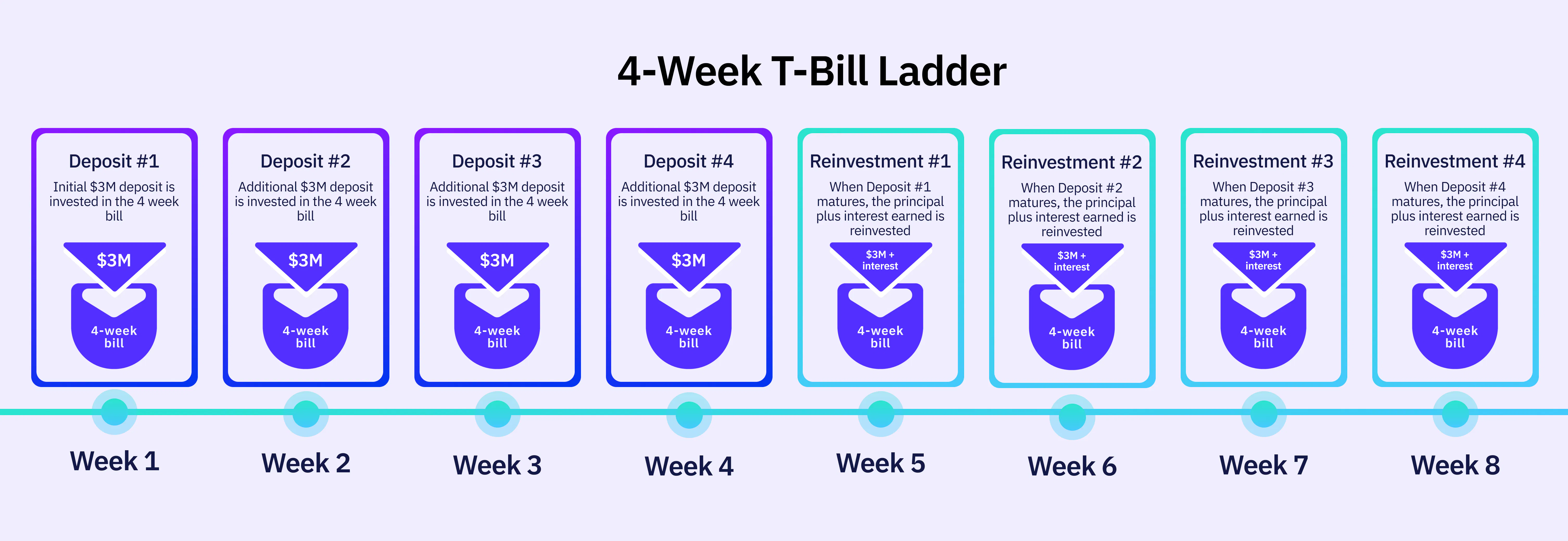

T-Bill Ladder Example

Let's say a Treasurer has $12M in excess cash to invest and decides to create a straightforward ladder that provides liquidity every week, using a single maturity, the 4-week T-bill.

Weeks 1-4: Initial Investments

Each week for 4 weeks straight, you invest $3M in the latest issuance of the 4-week T-bill.

Weeks 5-8: Ongoing Reinvestment

As each bill matures, you’ll receive your principal $3M investment plus the interest earned. At that point, you reinvest that $3M into a new 4-week T-bill.

By the end of Week 8, the Treasurer has established a continuous cycle where a 4-week T-bill matures every week, and the proceeds are reinvested into a new 4-week T-bill.

As mentioned above, T-bill ladders allow investors to customize their strategies to their liking. This ladder can be evolved to introduce longer-term maturities as part of the ladder.

Weeks 9-10: Introduce the 13-week T-bill

In Week 9, the proceeds from the maturing 4-week T-bills are reinvested into a 13-week T-bill, instead of purchasing a new 4-week T-bill. Similarly, in Week 10, the next maturing 4-week T-bill is reinvested into another 13-week T-bill. By the end of Week 10, the ladder will consist of two 13-week T-bills and two 4-week T-bills.

Laddering Mistakes to Avoid

While ladders can be beneficial in a variety of cash management strategies, establishing and consistently managing ladders is cumbersome work that not only involves buying Treasury bills directly from a broker. Trading T-bills through a broker-dealer can result in costly mistakes, like missing the execution price on each trade, missing an expiry, or selecting on-the-run CUSIPs.

In a corporate treasury scenario, laddering T-bills provides a dynamic and flexible strategy for managing cash reserves, ensuring a steady stream of maturing funds and optimized yield. Compared to holding a single T-bill, laddering offers better liquidity and opportunities for reinvestment to capture different interest rates, making it a more effective approach for managing short-term cash flow needs while optimizing long-term returns.

Further reading

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →

4 Questions Treasurers Should Ask Before Investing in a Money Market Fund

Ensuring the safety and liquidity of cash is paramount for treasury teams. Read more →

Case Study: How an Illinois Treasurer Optimized Public Funds Management with Jiko Pockets

Background When Thornton Township’s Treasurer, responsible for managing public funds for 12 Illinois school districts, attended the Association of Financial Professionals (AFP) Conference in 2023, they weren’t expecting to find a groundbreaking solution to their cash management challenges. Read more →