In today’s fast-paced, often volatile financial landscape, corporate treasurers face the critical task of managing cash reserves efficiently. While every decision made in corporate treasury has an impact on the bottom line, perhaps no decision is more important than how a company allocates its corporate cash. For many treasurers, the golden rule of cash management is clear: invest a set percentage of cash in U.S. Treasury bills (T-bills) at all times. This simple yet effective strategy provides safety, liquidity, and predictable returns—traits that are invaluable in an unpredictable world. But what is the right percentage? Let’s take a look at why T-bills should be a cornerstone of any corporate treasury strategy and best practices for T-bill allocation.

Why T-Bills? The Treasurer's Preferred Choice

U.S. Treasury bills are among the safest, most liquid, and lowest-risk financial instruments available to corporate treasurers. As short-term debt securities issued by the U.S. government, T-bills are backed by the full faith and credit of the U.S. government. For companies managing large cash reserves, the safety offered by T-bills is unparalleled.

Consider the example of Warren Buffett’s investment approach. Buffett, through his company Berkshire Hathaway, holds a significant portion of its cash in U.S. Treasury bills. According to reports, Berkshire Hathaway has consistently kept a portion of its reserves in T-bills, particularly when market conditions are uncertain. This approach reflects Buffett’s preference for safe, liquid assets during volatile market periods. Notably, in times of market crisis or economic uncertainty, Buffett has made substantial investments in T-bills, viewing them as a crucial safe haven.

The Case for Allocating Cash to T-Bills

As treasurers, ensuring the safety and liquidity of corporate cash is paramount, regardless of the state of the economic climate. A well-executed cash management strategy not only safeguards cash and maintains liquidity but also generates returns on those funds, striking the right balance between safety, accessibility, and performance. The decision to allocate a certain percentage of cash reserves to T-bills accomplishes each of those goals.

Liquidity

T-bills are highly liquid, meaning that they can be sold or redeemed almost instantly without a significant impact on price. This is crucial for treasury teams that need quick access to funds in case of unexpected operating expenses.

During periods of market stress, T-bills become a go-to investment for ensuring liquidity. Unlike other cash alternatives, such as Money Market Funds (MMFs), investors turn to T-bills because they are backed by the U.S. government, minimizing counterparty risk. In contrast, MMFs and other fund wrappers may encounter liquidity issues due to the risk of counterparties failing to meet obligations, especially in turbulent market conditions. This makes T-bills an even more attractive option when liquidity is of the utmost importance.

Risk Reduction

T-bills are often referred to as "risk-free" investments because they are backed by the full faith and credit of the U.S. government. There is no pooling or commingling of funds, so your investment remains isolated and secure. The credit risk is solely tied to the U.S. government, which provides corporate treasurers with confidence that their capital is safe, even in times of economic uncertainty. T-bills offer a strong layer of risk reduction by ensuring a stable return, making them a valuable component in balancing a portfolio, particularly during volatile periods.

Returns

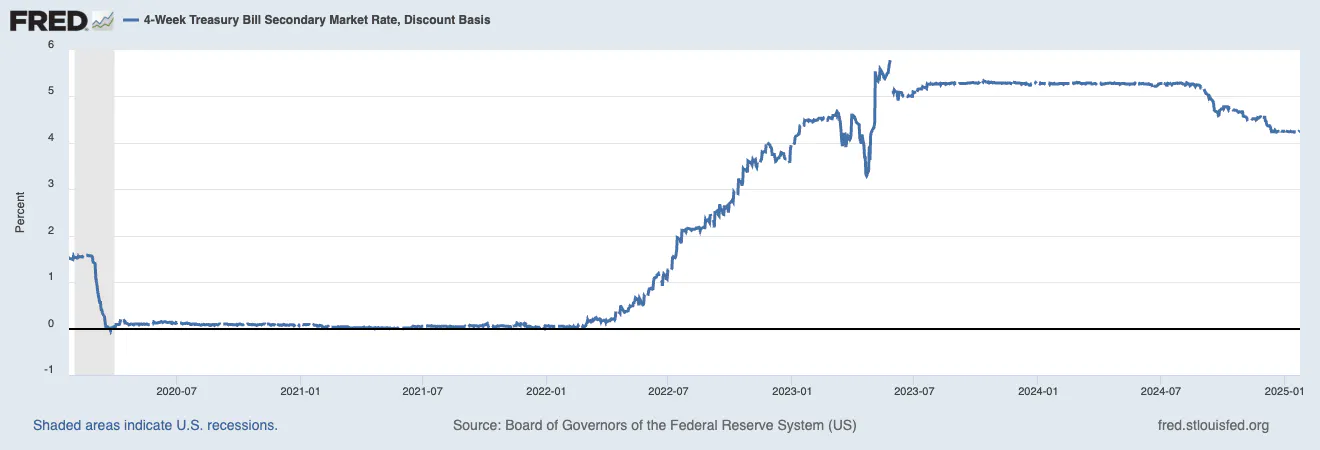

Last year, U.S. Treasury bills reached their near 20-year high in yield, reflecting a risen rate environment. This yield increase made T-bills an even more attractive option for corporate treasurers seeking a safe and profitable way to park cash. T-bills offer the ability to "lock in" a rate, providing certainty and predictability for cash management, especially when compared to other short-term cash alternatives like Government Money Market Funds that feature a variable rate depending on fund performance and fees.

In addition to their competitive yields, T-bills also have the advantage of being exempt from state and local taxes, further enhancing their return compared to other short-term cash destinations, which may be subject to higher tax rates. For treasurers, this means not only higher yields but also increased tax efficiency, helping maximize after-tax returns.

Board of Governors of the Federal Reserve System (US), 4-Week Treasury Bill Secondary Market Rate, Discount Basis (2020 to Present), retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTB4WK. As of January 24, 2025.

The Golden Rule: A Set Percentage in T-Bills

The golden rule for corporate treasury management is to always maintain a set percentage of cash in T-bills at all times. But what is the right percentage?

For many treasurers, the percentage varies based on factors like cash flow needs, operational cycles, and risk tolerance. However, a good benchmark is to invest between 30% and 60% of cash into T-bills.

By consistently allocating a portion of cash reserves to T-bills, corporate treasurers can reduce risk while generating competitive returns compared to alternative cash destinations like Money Market Funds. The risk-free nature of T-bills, high liquidity, and tax advantages make them an essential tool for safeguarding corporate capital—especially in an uncertain economic environment.

While allocations may vary, maintaining a disciplined approach to T-bill investment ensures financial resilience, enabling treasurers to navigate both routine operations and unexpected market shifts with confidence.

Further reading

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance. Given volatility is inevitable, ensuring safety across all economic environments is essential. Here’s a breakdown of the characteristics of both options and the risks involved in times of market stress.. Read more →

What is Even Safer Than a T-Bill Today? A T-Bill Tomorrow

Treasury Bills and the Debt Ceiling: A Look at Safety and Stability The US national debt is once again approaching the debt ceiling, reaching a point that forced Treasury Secretary Janet Yellen to take action and begin using extraordinary measures on January 21st. Read more →